Excitement About Kam Financial & Realty, Inc.

Excitement About Kam Financial & Realty, Inc.

Blog Article

Kam Financial & Realty, Inc. - Truths

Table of ContentsThe Only Guide to Kam Financial & Realty, Inc.The Main Principles Of Kam Financial & Realty, Inc. Kam Financial & Realty, Inc. for DummiesKam Financial & Realty, Inc. - The FactsSee This Report on Kam Financial & Realty, Inc.Some Ideas on Kam Financial & Realty, Inc. You Should KnowThe Of Kam Financial & Realty, Inc.Rumored Buzz on Kam Financial & Realty, Inc.

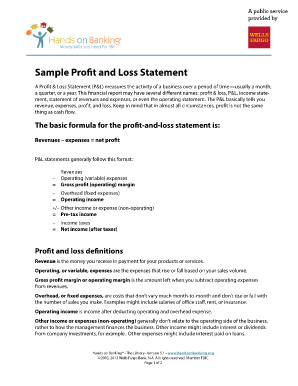

If your local region tax obligation rate is 1%, you'll be charged a residential or commercial property tax of $1,400 per yearor a month-to-month property tax obligation of $116. We're on the last leg of PITI: insurance coverage. That's not always a poor thing.Bear in mind that nice, expensive escrow account you had with your home tax obligations? As with your home tax obligations, you'll pay component of your house owner's insurance policy premium on top of your principal and passion settlement. Your loan provider gathers those payments in an account, and at the end of the year, your insurance coverage company will draw all that money when your insurance policy repayment is due.

The Main Principles Of Kam Financial & Realty, Inc.

It's indicated to secure the lending institution from youwell, at the very least from the possibility that you can not, or just level do not, make your mortgage payments. Certainly, that would never ever be youbut the loan provider does not care. If your deposit is much less than 20% of the home's price, you're going to obtain put with PMI.

If you belong to a community like among these, don't overlook your HOA cost. Depending upon the age and dimension of your house and the facilities, this might include anywhere from $50$350 to the quantity you pay every month for your general real estate costs. There are many kinds of home mortgages and they all charge various month-to-month repayment quantities.

An Unbiased View of Kam Financial & Realty, Inc.

Because you intend to obtain a mortgage the clever method, connect with our close friends at Churchill Home loan - mortgage lenders california. They'll walk with you every step of the method to put you on the most effective path to homeownership

The Greatest Guide To Kam Financial & Realty, Inc.

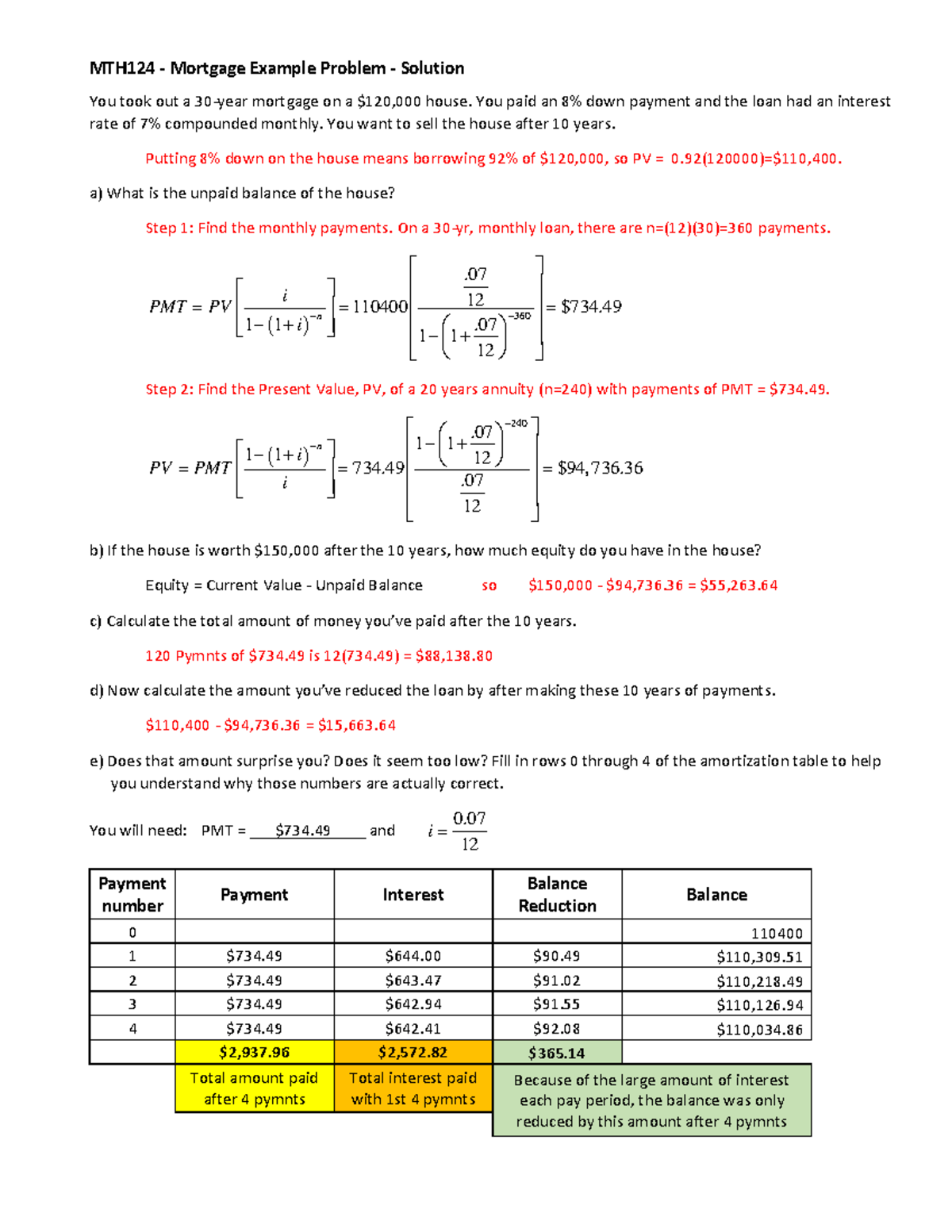

This is the most typical kind of mortgage. You can choose a term as much as three decades with most loan providers. The majority of the early settlements settle the rate of interest, while the majority of the later payments settle the principal (the first amount you obtained). You can take a table funding with a set price of rate of interest or a drifting rate. https://www.evernote.com/shard/s342/client/snv?isnewsnv=true¬eGuid=d89a1222-bb62-3be6-b6d8-e41c1a761460¬eKey=rSMQKTJCS5VUxMPMLtA9QayPsea3UkHl3eKu0qXJiDSrXVeRNouxaJBcJw&sn=https%3A%2F%2Fwww.evernote.com%2Fshard%2Fs342%2Fsh%2Fd89a1222-bb62-3be6-b6d8-e41c1a761460%2FrSMQKTJCS5VUxMPMLtA9QayPsea3UkHl3eKu0qXJiDSrXVeRNouxaJBcJw&title=Your%2BUltimate%2BGuide%2Bto%2Ba%2BMortgage%2BLoan%2BOfficer%2BCalifornia.

Many lenders bill around $200 to $400. This is frequently negotiable. california loan officer.: Table loans supply the discipline of routine payments and a collection day when they will certainly be repaid. They provide the assurance of knowing what your settlements will be, unless you have a floating price, in which case settlement amounts can alter

Some Known Incorrect Statements About Kam Financial & Realty, Inc.

Rotating credit report loans work like a huge overdraft. By keeping the funding as reduced as possible at any time, you pay much less passion since lenders calculate interest daily.

Application fees on revolving credit history mortgage can be up to $500. There can be a cost for the daily financial transactions you do through the account.: If you're well organised, you can settle your mortgage quicker. This additionally suits people with uneven revenue as there are no fixed payments.

Get This Report on Kam Financial & Realty, Inc.

Subtract the financial savings from the total financing amount, and you only pay passion on what's left. The more cash you keep across your accounts daily, the more you'll save, due to the fact that rate of interest is calculated daily. Linking as several accounts as possible whether from a partner, moms and dads, or various other relative suggests even less passion to pay.

Some Known Facts About Kam Financial & Realty, Inc..

Repayments start high, however decrease (in a straight line) with time. Charges are similar to table loans.: We pay much less interest overall than with a table financing since very early repayments include a higher settlement of principal. These may match customers that expect their revenue to drop, as an example, if one partner plans to offer up work in a couple of years' time.

We pay the interest-only component of our payments, not the principal, so the settlements are lower. Some debtors take an interest-only car loan for a year or more and then change to a table loan. The typical table loan application charges apply.: We have extra money for various other points, such as remodellings.

A Biased View of Kam Financial & Realty, Inc.

We will still owe the sum total that we borrowed until the interest-only period ends see it here and we start paying back the financing.

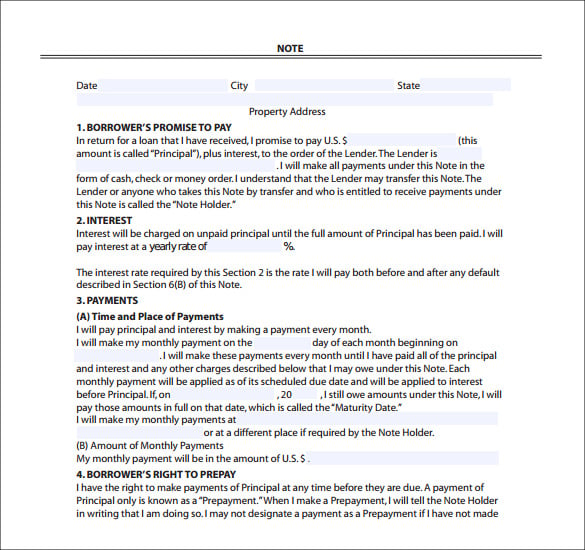

The home mortgage note is generally recorded in the public documents in addition to the home mortgage or the act of trust and acts as proof of the lien on the home. The home loan note and the home loan or deed of count on are two various records, and they both offer various legal purposes.

Report this page